SHARE:

A Florida TaxWatch economic report

The Effect of Changes in the National Flood Insurance Program on Florida

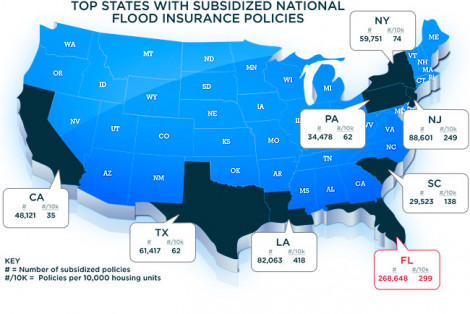

Last year, the U.S. Congress passed the Biggert-Waters Flood Insurance Reform Act, which extends the National Flood Insurance Program (NFIP) for five years and makes changes to the program’s major components, including flood insurance, flood hazard mapping, grants, and management of floodplains.1 The Act is intended to make the program solvent by reducing subsidies and moving to actuarially sound rates to eliminate its estimated $24 billion of debt.

In 1968, the U.S. Congress created the NFIP, which allowed homeowners in participating communities to purchase flood insurance if the community followed flood management ordinances and adopted standards for new construction. These ordinances did not affect existing homes and many received subsidized rates because the rates charged did not reflect the true risk of the property. As flood damage and program costs rose, the NFIP operated with a deficit.

| NFIP At a Glance 2, 3, 4 | |

| NFIP Total Exposure: $1.27 trillion | |

| NFIP Premium Receipts Annually: $3.5 billion | |

| Top State Exposure | |

| Florida | $475 billion |

| Texas |

$162 billion |

| Louisiana |

$112 billion |

| Aggregate Subsidized % -- 20% | |

| Florida Subsidized % -- 13% | |

A substantial portion of the current $24 billion debt of the NFIP is due to claims from Hurricane Katrina and Hurricane Sandy. Hurricane Sandy claims were estimated at $12 to $15 billion by the Congressional Research Service in a February 2013 report, which would rank Sandy as the second-highest payout of flood insurance claims from the program.5

In Florida, Tropical Storm Isaac in 2012 saw $407 million in paid claims, ranking 13th nationally by dollar, and Hurricane Wilma in 2005, which resulted in $365 million in claims paid, ranking 15th nationally.

"The Effect of Changes in the National Flood Insurance Program on Florida"

1 Federal Emergency Management Agency (PDF)

2 Resources for the Future, November 2012.

3 New York Times, Nov. 13, 2012.

4 Sun Sentinel.“Flood Insurance Rate Increase hits hard in Florida.”

5 The National Flood Insurance Program: Status and Remaining Issues for Congress.

» NEXT PAGE: Which Florida Counties are most affected?

Comments