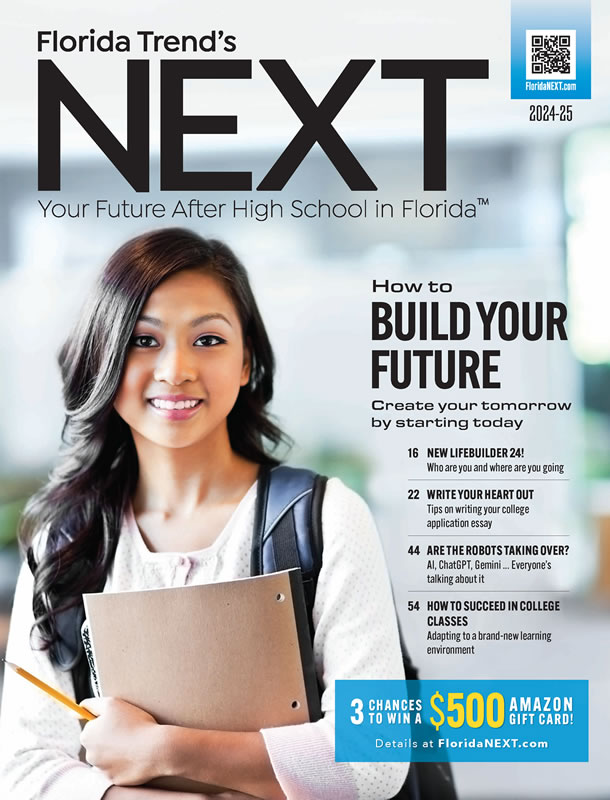

Monterra development in Cooper City [Photo:Eileen Escarda] |

Searching the debris field left by the crash of the real estate market in Florida, investors Armando Codina and Jim Carr found a salvageable project. Monterra, in south Broward County, had location — equidistant from I-75 and I-95, a short hop to Miami. Hollywood-based home builder Tousa had bought the site, a dairy farm, in the boom and envisioned 1,610 homes.

To finance construction of streets, water pipes and other infrastructure, Tousa used a vehicle fairly common in new developments in Florida. With the county’s blessing, it created for Monterra a community development district, a quasi-governmental entity that can borrow money in the bond market and tax its property owners to pay the bonds off.

The Tousa-controlled district — one of 73 formed in Florida in 2005 — sold $129 million in bonds. Developers make the initial payments on CDD bonds, known as “dirt bonds,” with homeowners assuming a bigger share of the debt service as they buy homes.

But real estate collapsed, Tousa went bankrupt in 2008 and the bonds, like plenty of dirt bonds in Florida, tumbled in value. Codina and Carr bought the Monterra bonds at a discount, along with the land backing them as well as the mortgage on that land. Now, with their low basis in the property, they are turning a profit by selling new homes for prices competitive with what foreclosed homes, short-sale deals and other new homes in the area fetch.

Builder Jim Carr and business partner Armando Codina bought the community development district bonds for the Monterra development in Cooper City at a 29% discount. [Photo: Eileen Escarda] |

In the tangled world of current real estate finance, not all dirt bond disasters are likely to work out so neatly.

As of May, Florida had 125 districts in default on more than $3 billion in bonds, the single biggest muni bond default wave in at least 30 years, says Richard Lehmann, a Forbes columnist and publisher of Miami Lakes-based Distressed Debt Securities. He says another 70 districts are teetering toward default. Troubled Florida community development districts became such a hot topic that last year he launched floridacddreport.com just to track them.

Another firm, Bedford, Mass.-based Interactive Data, says $2.4 billion, or more than 40%, of the $5.6 billion in dirt bonds it monitors, failed to make interest payments in November or had to draw against reserves to do so. “That’s certainly an unprecedented state of affairs,” says Mark Heckert, senior director of evaluated services for Interactive.

Nearly all the bonds were issued from 2004 to 2007 and represent projects across Florida, though a quarter are in the Tampa area.

Too many districts?

Community development districts, which originated in the 1980s, grew to become a well-established and useful mechanism in real estate development in the last two decades. Local governments reaped a growing tax base without having to fund infrastructure. Developers, through the bond sales, borrowed at competitive rates, got good terms and kept control of projects. (Developers generally control districts for six years, as long as they own a majority of the acreage.) Bond buyers, large mutual funds, had a safe, tax-free investment.

Until the recession, the districts were usually all upside in fast-growing states such as Florida. Now, while mature districts — bond repayment typically stretches over 30 years — have little financial trouble, bubble-era districts can’t make their bond payments as developers and builders fail or bail.

Lehmann says the Florida Legislature should address whether counties let developers create too many districts. He also says Florida should follow other states in regulating how bond proceeds are spent. Bond investors burned in the current crash will want higher rates to offset the risk of financing future Florida development.

But for now the problem is how to mend distressed districts. The historic answers

The Monterra and Tison deals were tough to pull off, warns developer Armando Codina. Most CDDs are not attractive investments, he says. |

— population growth and rising land values — don’t look promising in an economy rife with high unemployment, high insurance rates, rising property taxes, dwindled in-migration and all those competing fire-sale foreclosed homes.

“It’s getting crunch time for a lot of these districts,” says analyst Andrew Sanford of Naples-based ITG Holdings, a debt-workout specialist. In some, development has halted, scaring away buyers and leaving not much in the way of lots ready for homes and sales. Other projects, conceived in an era of high growth and speculation, no longer make sense. Restarting projects, he says, is “an uphill battle with a lot of risk associated with it.”

Reducing the bond debt each lot owes is the key to resuscitating developments and districts. But that requires complex negotiations that must satisfy dirt-bond holders, developers or whoever now has title to the land, and perhaps a new developer or builder. Bond holders are motivated, says public finance attorney Bill Capko. “Most of the bond holders don’t want to be in the situation of being the property owner,” says Capko, a shareholder in the West Palm Beach office of Lewis, Longman & Walker, a firm that is general counsel for the Florida Association of Special Districts.

Brian Stock, CEO of family-owned Stock Development in Naples, says he has met with “good cooperation” in working with bondholders in the last year and “made a lot of progress” restructuring the $43.1 million in dirt bonds outstanding on his company’s Paseo, a 444-acre project in Fort Myers. Stock has stuck with the project, selling 330 of a slated 1,138 units since opening in 2005. “We’re having a good selling season this year so far,” Stock says.

Troubled dirt bonds are of particular concern to the banks that hold mortgages on distressed projects. The reason: Dirt bond assessments, like property taxes, take precedence over all other claims on the land as collateral, including first mortgages. Almost by definition, when dirt bonds trade at a discount, the mortgages on the same property are worthless.

| CDD Formation in Florida The number of community development districts created in Florida, by year  Source: Florida Department of Community Affairs |

It takes liquidity and acumen. Codina and Carr had both when they seized the opportunity presented by Monterra and Tison’s Landing, a 218-acre project in north Jacksonville now named Yellow Bluff Landing. They paid 71 cents on the dollar for Monterra’s bonds and bought Tison’s $36.9 million in bonds for 28 cents on the dollar. Carr is a longtime south Florida builder and in-fill specialist, while Codina is a large-scale commercial developer who serves on the boards of American Airlines and Home Depot and was the largest private shareholder at Flagler Development, one of Florida’s largest commercial property firms.

Codina warns that the Monterra and Tison deals were tough to pull off. Those two projects, he says, were attractive investments, unlike many other districts. Says Codina, “The ones that got built in the places they never should have, I wouldn’t buy them at any price.”

Codina and Carr bought $36.9 million in bonds on the 218-acre Yellow Bluff Landing (formerly known as Tison’s Landing) in Jacksonville for 28 cents on the dollar.  |