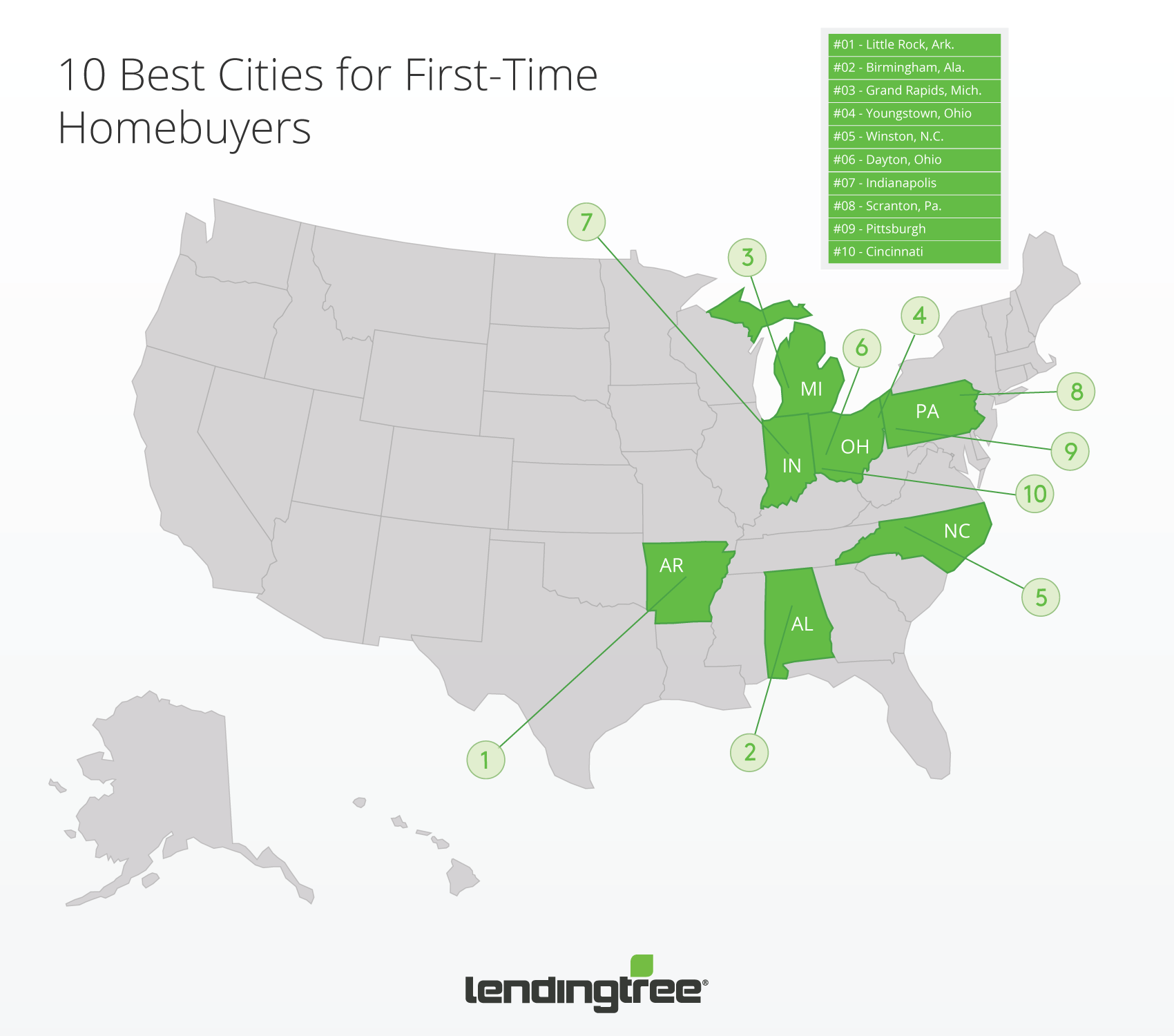

As rising prices reduce buying power in some areas, LendingTree study reveals most accessible markets for first-time homebuyers

Ten years after the housing crisis, national home prices have now surpassed prior peaks, inventory is tight, and homebuyers are facing bidding wars. These challenges are even more onerous for first-time homebuyers, who cannot capitalize on profits from an existing home sale to at least partially fund the down payment for a new home. However, homeownership is still attainable for first-time homebuyers, and some cities have more favorable conditions for those considering homeownership.

In a new study, LendingTree ranked the best cities for first-time homebuyers in the nation's 100 largest cities. The factors that made a housing market favorable were:

- Average down payment amount. The big initial pile of cash is something most first-time buyers struggle with and takes years of savings for many.

- The share of buyers using an FHA mortgage. Buyers using FHA financing are required to put down as little as 3%, and have higher limits on the debt-to-income ratios. These and other loan features increase the likelihood of being approved for a mortgage while still getting competitive mortgage interest rates.

- Average down payment percentage. Lower down payments increase access for first-time buyers. Down payments are one of the main obstacles to home ownership, as many renters can afford the monthly mortgage payment.

- Percentage of buyers who have less than prime credit (below 680). First-time buyers often have lower credit scores than repeat buyers so are more competitive in areas without as many prime borrowers.

- The share of homes sold that the median income family can afford (Housing Opportunity Index). Many cities have become too expensive for the median family. This measure of affordability in our ranking elevates cities that are still affordable for median income families.

- Average FHA down payment as a percentage of average down payment for all loans: The lower down payment for FHA loans is more valuable in some areas than others. This measure of the FHA benefit tells us how much FHA borrowers truly saved on down payments.

Several down payment variables are included in the ranking because research has identified down payments as the biggest obstacles to home ownership. The various down payment measurements are not precisely correlated, however each figure is helpful for consumers considering homeownership.

Most Accessible Cities for First-Time Homebuyers:

- Little Rock, Ark.

- Birmingham, Ala.

- Grand Rapids, Mich.

- Youngstown, Ohio

- Winston, N.C.

- Dayton, Ohio

- Indianapolis

- Scranton, Pa.

- Pittsburgh

- Cincinnati

Little Rock rolls out the welcome mat.

Little Rock did not top any of the six criteria but was in the top 20 in all categories, giving it the best aggregate ranking. Its best attribute is a low average down payment of just 12% or $24,896. It also scores well in the share of non-prime homebuyers at an even 50%.

Birmingham puts another southern city second.

Birmingham scored particularly well on the down payment percentage at just 12% with a down payment amount at just over $27,000.

Grand Rapids is the best place to be an FHA borrower.

Grand Rapids tops the rankings for non-prime credit share of FHA borrowers at 59% and FHA benefit with a down payment at just 22% of the amount paid by other borrowers.

Ohio, Pennsylvania, Michigan and Indiana present homebuying opportunities.

Twelve of the top 15 cities are in this cluster of industrial states. Access for first-time homebuyers is great as home prices have not outpaced the growth in the economy and affordability is high.

On the other side of the spectrum are markets where home prices and down payments are high, the FHA share is low, and home prices exceed affordability thresholds.

Most Challenging Cities of First-Time Homebuyers:

- Denver

- New York City

- San Francisco

- Austin, Texas

- Las Vegas

- Los Angeles

- Oxnard, Calif.

- Boston

- Sacramento, Calif.

- Miami

Denver is the most challenging.

Denver is not the most challenging city in any single measure, but weak showings across the board could create obstacles for first-time buyers. Down payments are high at $66,806, and even the FHA down payment is a considerable $22,841.

Many large cities in bottom 10.

New York, San Francisco, Los Angeles, Boston and Miami are all in the bottom 10 of our listing, scoring poorly across the board in our metrics. These metros have higher income inequality than the national average and higher home prices than the national average. This puts homes out of reach for many renters who also struggle to raise down payments given high rental prices.

Some surprising cities in the bottom 10.

Las Vegas and Austin both had very low shares of FHA and non-prime borrowers and didn't rank particularly well in other metrics. These are both very popular smaller cities that may be seeing external buyers crowding out the local population.

"In addition to tight inventory boosting prices in many markets, first-time homebuyers must now contend with rising mortgage interest rates, further reducing their buying power," said Tendayi Kapfidze, chief economist at LendingTree. "As affordability declines, borrowers should consider all the programs available to assist them in becoming homeowners, including FHA loans. A home can be a valuable asset for Americans, as long as consumers stick to homes well within their budgets."

The full report is available here.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation's leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.