The Effect of Changes in the National Flood Insurance Program on Florida

Last year, the U.S. Congress passed the Biggert-Waters Flood Insurance Reform Act, which extends the National Flood Insurance Program (NFIP) for five years and makes changes to the program’s major components, including flood insurance, flood hazard mapping, grants, and management of floodplains.1 The Act is intended to make the program solvent by reducing subsidies and moving to actuarially sound rates to eliminate its estimated $24 billion of debt.

In 1968, the U.S. Congress created the NFIP, which allowed homeowners in participating communities to purchase flood insurance if the community followed flood management ordinances and adopted standards for new construction. These ordinances did not affect existing homes and many received subsidized rates because the rates charged did not reflect the true risk of the property. As flood damage and program costs rose, the NFIP operated with a deficit.

| NFIP At a Glance 2, 3, 4 | |

| NFIP Total Exposure: $1.27 trillion | |

| NFIP Premium Receipts Annually: $3.5 billion | |

| Top State Exposure | |

| Florida | $475 billion |

| Texas |

$162 billion |

| Louisiana |

$112 billion |

| Aggregate Subsidized % -- 20% | |

| Florida Subsidized % -- 13% | |

A substantial portion of the current $24 billion debt of the NFIP is due to claims from Hurricane Katrina and Hurricane Sandy. Hurricane Sandy claims were estimated at $12 to $15 billion by the Congressional Research Service in a February 2013 report, which would rank Sandy as the second-highest payout of flood insurance claims from the program.5

In Florida, Tropical Storm Isaac in 2012 saw $407 million in paid claims, ranking 13th nationally by dollar, and Hurricane Wilma in 2005, which resulted in $365 million in claims paid, ranking 15th nationally.

"The Effect of Changes in the National Flood Insurance Program on Florida"

1 Federal Emergency Management Agency (PDF)

2 Resources for the Future, November 2012.

3 New York Times, Nov. 13, 2012.

4 Sun Sentinel.“Flood Insurance Rate Increase hits hard in Florida.”

5 The National Flood Insurance Program: Status and Remaining Issues for Congress.

» NEXT PAGE: Which Florida Counties are most affected?

Which Florida Counties are most affected?

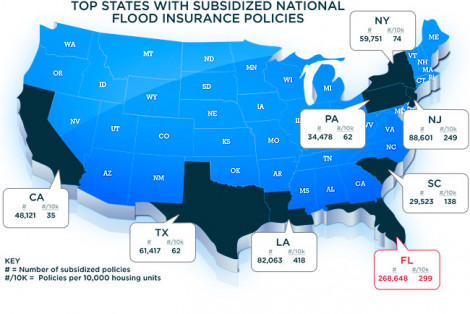

Florida has more than 2.05 million policies and 268,648 (13 percent) are subsidized.6 As these policies are moved to actuarially-sound rates, as required in the Reform Act, Pinellas, Miami-Dade, and Lee counties will be most affected by the subsequent increases in policy costs, as these counties contain almost 48 percent of the subsidized policies.

Although not the leader in subsidized policies, Monroe County has, by far, the highest density of subsidized policies, with 2,244 per 10,000 housing units, more than double the density of Florida’s next-highest county: Pinellas, which leads in number of subsidized policies.

| Top Florida Counties with Subsidized NFIP Policies | ||

| County |

# Subsidized policies |

Subsidies Per 10k Units |

| Pinellas |

50,255 | 998 |

| Miami-Dade |

47,442 | 479 |

| Lee |

30,398 | 819 |

| Broward |

19,425 | 240 |

| Sarasota |

18,770 | 822 |

| Collier |

17,133 | 868 |

| Hillsborough |

14,368 | 268 |

| Monroe | 11,840 | 2,244 |

Floridians paid $3.60 in Premiums for Every $1 collected in Flood Claims

| States Receiving More in Payout $ Than They Paid in Premiums | |

| State | Claim $ Paid Per Premium Dollar |

| Mississippi |

$5.00 |

| Louisiana |

$3.33 |

| Alabama |

$2.50 |

| Missouri |

$2.50 |

| North Dakota |

$2.50 |

| Iowa |

$2.00 |

| Texas |

$1.43 |

| Minnesota |

$1.43 |

| West Virginia |

$1.43 |

| Oklahoma |

$1.11 |

| Kentucky | $1.11 |

| 1978 - 2008 NFIP Data | |

In a study done by the Wharton Center for Risk Management and Decision Processes, the amount of claims paid to states was compared to the amount of flood insurance premiums collected over the period of 1978–2008.7 This study showed that Floridians paid $3.60 in premiums for every $1 collected in flood claims from the program. This put Florida as the 14th-largest donor to the program. Leading the pack were Colorado ($15.1) and New Mexico ($10.4) in premiums paid per dollar received in claims during the period of the study.

Interestingly, 11 states have received more in payouts over the 30-year period of the study than their policyholders paid in premiums, with 6 of those states receiving double or higher what they paid in premiums.

6 Map: NFIP Policyholders: Total Number of Subsidized Policies by State and County (as of 12/31/2012).

7 Catastrophe Economics: The National Flood Insurance Program, Journal of Economic Perspectives. Volume 24, Number 4. Fall 2010.

» NEXT PAGE: The Effects on Florida Individuals, Businesses and Local Governments

Rescuers traverse flood waters searching for those in need of help. [Photo: NOAA]

The Effects on Florida Individuals, Businesses and Local Governments

The changes required by the Biggert-Waters Act are already affecting home sales in Florida, when purchasers or potential purchasers learn of the increased costs of the new flood insurance rate structure. This could continue to lead to significant reductions in home sales and values, and to reductions of county tax receipts as property values are re-calculated accordingly.

Legislative and Judicial Options

"The Effect of Changes in the National Flood Insurance Program on Florida"

Multiple bills are being considered by the U.S. Congress to delay implementation of the Act, proponents arguing that substantial increases in policy premiums will hurt many individuals, as well as economies still recovering from the most recent recession.

Florida was joined by Alabama in filing an Amicus Curae brief in early November 2013 in a lawsuit originally filed by Mississippi against FEMA arguing that FEMA failed to complete the required affordability study before implementing the Biggert-Waters Act, and that they based rates on outdated information. The brief asks the Court to compel FEMA to complete the required studies, and take into account the economic impact of the bill before implementing it.

Conclusion

The implementation of the Biggert-Waters Act will be important to Floridians who live and work in and around our most populated floodplain areas. An economic impact analysis of removing the federal subsidies should be conducted to determine the likely impact on Florida’s economy.

TAXWATCH CENTER FOR COMPETITIVE FLORIDA ADVISORY BOARD

BOARD CHAIRMAN

SENATOR GEORGE LEMIEUX

Chairman of the Board, Gunster

BOARD MEMBERS

MR. JOHN B. ZUMWALT III

President, thezumwaltcompany

Florida TaxWatch Chairman & Immediate Past Chair, CCF Advisory Board

"The Effect of Changes in the National Flood Insurance Program on Florida"

WILLIAM E. CARLSON, JR

President, Tucker/Hall

MR. MARSHALL CRISER, III

President, AT&T Florida

Immediate Past Chairman, Florida TaxWatch

MR. DOUG DAVIDSON

Market Executive, Bank of America Merrill Lynch

MR. J. CHARLES GRAY

Chairman, GrayRobinson Law Firm

MR. JON FERRANDO

Executive VP & General Counsel, AutoNation, Inc.

GOVERNOR BOB MARTINEZ

Sr. Policy Advisor, Holland & Knight

MR. DAVE MCINTOSH

Trustee, BlueField Ranch Mitigation Bank Trust

MR. JAMES M. REPP

Senior VP, AvMed Health Plans

MS. MICHELLE A ROBINSON

President, SouthEast Region, Verizon

MR. DAVID A. SMITH

Former Chairman, Florida TaxWatch

MR. MICHAEL SOLE

VP for State Governmental Affairs, Florida Power & Light

TRACY WILLIS

Vice President, The Walt Disney Company

Economic Commentary written by

Jerry D. Parrish, Ph.D., Chief Economist, and Executive Director of the Center for Competitive Florida, with assistance from Jennifer Linares, MS, Research Analyst.

Robert Weissert, Chief Research Officer & General Counsel

Chris Barry, Director of Publications

John Zumwalt, III, Chair, Florida TaxWatch

Sen. George LeMieux Chair, Center for Competitive Florida

Dominic M. Calabro, President, CEO, Publisher, and Editor

Florida TaxWatch Research Institute, Inc.

www.floridataxwatch.org

Copyright © Florida TaxWatch, November 2013